The idea of Investment is generally a tough nut to crack. There are many facets involved. But in this age and time, investments are almost impossible to ignore. They have found a way to be part of everyday life as some form of exchange.

Even with this development, not everyone has the technical know-how to proceed. That's where Voxtrend Putere comes in. We are a website dedicated to bridging the gap between people interested in learning about investments and firms equipped to teach.

Voxtrend Putere is all about helping enthusiastic people learn about the world of investments. The best part is that it's all for free! All it takes is for the person to register on the site! There's a lot to take in. So, sit back and enjoy the ride by signing up on Voxtrend Putere.

The essence of communication is not achieved if there is no understanding. Voxtrend Putere is intentional about financial education. Through the availability of different languages, education is accessible to all.

Users are linked to investment education firms. These firms provide relevant financial information. All these are tailored to the user’s needs and objectives. Hence, we ensure that the learning experience is truly personalized.

The collaboration between Voxtrend Putere and education firms brings educational resources and training right to the user.

With Voxtrend Putere, users need not worry about paying a dime. Our website is free and accessible to all. With a simple sign-up process, anyone can enjoy our services.

In a bid to carry everyone along, we provide access to resources for interested persons. We do this by linking them with investment educator firms.

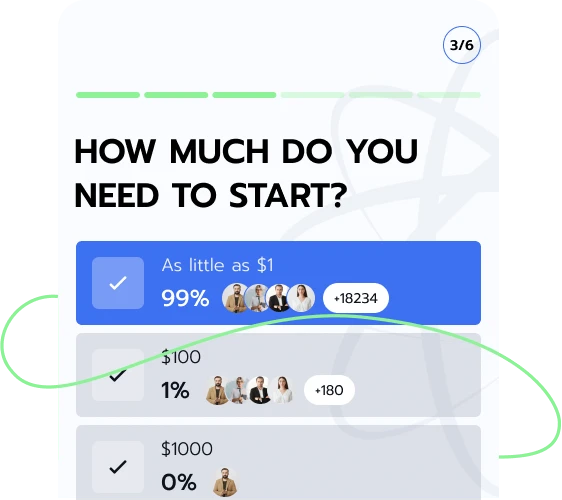

The first step is straightforward. Prospective users are required to provide primary personal data. Data such as their names, contact details, and email addresses. They are then connected to investment education firms that suit their needs.

With the details above, people can easily connect with an education firm. These firms are keenly tailored to their learning objectives. Get ready for an enlightening ride with Voxtrend Putere.

A representative from the investment education firm reaches out to users. In collaboration with the user, they work towards achieving the learning objectives. This includes outlining educational goals. It also ensures adequate utilization of necessary resources.

Imagine a family trying to manage the milk left. Picture them trying to make sure they have enough to use till the end of the month. This is precisely what financial management is about. But of course, with a little technicality.

Financial management is handling funds the right way. But what is the “right way?” It is important to note that nothing is promised in investments. People are responsible for their choices. By saving for emergencies and other personal investments, people may make informed financial decisions. These decisions may guide them toward long-term financial development. Sign up on Voxtrend Putere. Get connected to education firms and learn more about financial management.

When hunters go to hunt, they wait to get a good hold of their prey. The same logic is applied here. In investments, the investors may monitor closely and wait till a company experiences a downturn. They then seize an opportunity to act. They wait for the market to recognize the company's value. This, among many others, is a possible investment strategy. Investment strategies are a set of principles intended to guide people to make informed decisions. Interested persons can learn more when they sign up on Voxtrend Putere. Below are some of the strategies that investors employ;

This is a sort of “can see the potential” kind of strategy. Here, investors decide on stocks that are seemingly underestimated in their assessments. However, based on financial analysis, they hold these stocks. They may appear to be given less value than they are actually worth.

This strategy means buying a stock or asset and holding it until it “matures.” Mature, in this sense, may mean until it appreciates and brings gains. The person in question will most often hold for an extended period. This is irrespective of the wavering behavior of the market.

Growth Investing

Investors target rapidly expanding companies. They do this despite the greater risk and volatility.

Income Investing

Income investing may bring regular returns. This might be through dividend stocks, bonds, real estate investment trusts (REITs), or other assets.

Index Investing

Index investing is a kind of “just in case” investment. Investors can't predict the market because it is volatile. What they can do is buy a little bit of everything in the stock market. This is to ensure they may be well positioned however things go. However, this has its downsides, including the possibility of losing out if there's a shaking that generally affects the market.

But in the long run, this passive style of investing is playing safe. The investor in question may not have to worry about the investments that might do well because they have a little bit of everything.

It is the purchasing of assets that have shown positive trends in price movement. The idea is that these assets may still have the prospects of performing well.

Dollar-cost averaging (DCA) is the process of periodically capitalizing a fixed amount of funds into a particular investment. This is done regardless of the share price or market conditions. It may help shape people's investment habits.

An investor may adopt the DCA method by periodically investing in ETFs or other stocks. Rather than worrying and waiting for the time to buy, they might adopt the principle of consistency.

Regardless of the market fluctuation, the investor is reminded of the shares that may have appreciated over time. Interested people can learn more about DCA by signing up for free on Voxtrend Putere.

Right from the inception of man, comparisons have always been made. With finance, there is no exemption. Comparable Company Analysis Duration (CCA) is a valuation method. It is also known as “peer group analysis” or “comps.” It is used to determine the value of a company as overvalued or undervalued. This is done by comparing it to similar publicly traded companies.

Industry classification is essential in choosing comparable companies. The companies being compared must share similar characteristics. Characteristics such as the size of the companies. The financial data of the compared companies are collected and standardized for analysis. Sign up on Voxtrend Putere to learn more. Here are some guides on how to choose comparable companies;

The first step is to compile a list of companies operating in the same industry. This is done using industry reports or financial databases. These companies become the target companies. The target companies must be similar in size and market capitalization.

One must ensure that the compared companies are exposed to similar industry dynamics. Factors like industry trends and macroeconomic factors are considered. This is because they might affect the target company.

This is as simplified as it gets. Financial metrics are checkboxes that help one understand how well a firm is doing revenue-wise. These metrics may involve things like gain margin. They also help to compare how much a company makes to how much goes back into the business. These tools may be used to help locate an investment opportunity.

Another factor is to consider companies operating in the same geographical boundary as the target company. This is because they’re likely to face similar market situations. Differences in geographical diversification may affect business performance.

The Portfolio Optimization Model is a mathematical framework. It objectively examines a collection of investment portfolios. This approach is intended to create a diversified investment portfolio. As a result, it may score the highest/lowest possible outcome at a given risk.

This model mathematically identifies the optimal allocation of assets. This may be done to meet the intended goal of maximizing return or minimizing risk. Common optimization algorithms include mean-variance optimization, quadratic programming, and linear programming. The output of a portfolio optimization model is graphically represented by a curve known as the “efficient frontier.” Find out more by signing up on Voxtrend Putere.

Imagine this: There is a person who is a stockholder or shareholder in a company. Over time, the company appreciates on the stock market, and this personё's stock or shares in the company yield dividends.

Now, this person isn't interested in taking out all of his “rewards” from owning stocks or shares of the firm. Instead, he wants to reinvest. Dividend Reinvestment Plans, or DRIPs, are a kind of savings plan that accommodates that choice.

This may allow for the person's reinvested funds to yield possible compound rewards over time. The process or duration of reinvestment depends on the structuring of the company. If the company does better stock-wise, the dividends reinvested do the same. Interested persons can register for free on Voxtrend Putere and learn more.

This is some sort of ‘first time out” for companies in the investment space. For instance, there's a particular asset a person likes, and it's been concealed for a while. The concealing makes it a private asset. But when there's a switch, the asset becomes public. This means people get to interact or buy the asset for the first time. This is the general idea behind initial public offerings. Some companies do this in order to raise funds to help expansion and development. To know more, register for free on Voxtrend Putere!

The company gets investment banks as underwriters. They write convincing proposals on their behalf. This gives the public reasons to invest. Basically they act as an intermediary between the company and intended investors.

The Securities and Exchange Commission reviews the company's registration statement. This is done to confirm their adherence to regulations for public companies. This is because they operate as a protective agency for the public.

The company pulls together all its account data alongside legal information. This is to give the public a full overview of the company's history. This creates reliability for healthy engagement and collaboration.

The company’s management team and underwriters go on a roadshow. This means to market the shares to prospective investors via meetings.

The company submits a registration statement to securities regulators. These regulators are responsible for administering a sort of “go-ahead” for the company.

At this stage, the IPO team and underwriters determine the value price for the shares. This is done based on investors' demand and company financials. Only after regulatory approval can they set the IPO price.

To put it all together, the need for financial and investment enlightenment is paramount.

This is where Voxtrend Putere comes in to bridge the gap between interested learners and investment education firms. There is much to learn, unlearn, and get into. Start by signing up on Voxtrend Putere for free!

| 🤖 Joining Cost | No fees for registration |

| 💰 Operational Fees | No costs whatsoever |

| 📋 Registration Simplicity | Registration is quick and uncomplicated |

| 📊 Focus of Education | Lessons on Cryptocurrencies, Forex Trading, and Investments |

| 🌎 Countries Covered | Excludes the USA, covers most other countries |